This is part 3 of a series on String Theory Performing Arts Charter School in Philadelphia. I did a basic history of their massive 2013 bond issuance here. Then I analyzed a 2020 issuance here.

Last time, I dug around String Theory Development Corporation’s 2020 bond issuance to see what it was all about. This time, let’s get to some more amazing details of it as an apparatus: the entities involved and how they relate to one another.

There are a ton of characters in the drama called String Theory Development Corporation. The main characters are the DeMedicis and ‘the Corporation’.

Let’s start with the Corporation.

This is (not) a school

Technically, the Corporation refers to String Theory’s Performing Arts School. But confusingly the corporation is also the non-profit controlling the school. And thus also not the school.

While there isn’t anything to the Corporation other than the School, for legal purposes the School and Corporation are different. But they’re also the same. The way the issuance puts it:

The Corporation was incorporated in 2000 and operates as the public charter school known as Philadelphia Performing Arts: A String Theory Charter School (the “School”)

So the Corporation operates as the school, but is different than the school. I’m laughing right now over my keyboard. The School both is and is not a Corporation.

Where’s String Theory in all this? It’s actually a third thing that provides academic and business services to the Corporation for the School.

The Corporation has entered into an Academic and Business Services Agreement dated June 20, 2011…by and between String Theory Schools (“String Theory”) and the Corporation, pursuant to which String Theory provides academic and business services to the Corporation for the School.

In other words, “The Corporation relies on String Theory for all aspects of operation of the School.” So the corporation operates as the school but isn’t the school and also relies on String Theory for all aspects of operating the school.

Right.

Financially, this means that “the Corporation pays to String Theory a total annual fee of $2,253,562.50 for the 2020-21 school year, increasing year-over-year to $2,468,187.50 for the 2023-24 school year.” So the Corporation, which operates as the school, pays String Theory, its business services provider, millions of dollars to operate the school. Which both is and is not the Corporation.

It’s a late-capitalist postmodern mereological wonderland! And it only gets better. What about these DeMedicis?

Closer and closer apart

The DeMedicis are two non-profit corporations (DeMedici and DeMedici II) located in New Jersey whose sole reason for existing is to acquire and lease buildings to String Theory.

Sidenote: can you believe they’re actually called DeMedici? Like the Renaissance ruling class Italian family?

I digress. How do these DeMedicis relate to the Corporation (which is and is not a school)? Bond issuances are long, but they’re very repetitive. One paragraph repeated multiple times throughout this one is:

The Corporation does not exercise corporate control over DeMedici or DeMedici II, but there is certain common membership across the boards of directors of the Corporation, DeMedici, and DeMedici II. DeMedici and DeMedici II are legally separate from the Corporation, but are component units of the Corporation for purposes of financial reporting.

You guessed it: the DeMedicis are both component parts of the Corporation (for financial reporting purposes) but are not part of the Corporation (for legal purposes).

Financially speaking, these things are all connected to one another. Legally speaking, they’re separate.

LOL.

Indeed, Javier Kuehnle is president of all three: DM, DM2, and the School (which both is and is not the Corporation).

So what’s the practical relationship here?

As I wrote about last time, DM is the Corporation’s landlord. DeMedici, which both is and is not part of the school, leases some of the buildings to the Corporation, which, both is and is not the school. DeMedici II acquires and leases some facilities as well.

The DMs are also borrowers. They borrow the money from PAID (who is borrowing it from an anonymous cabal of ruling class people).

Here we have the basic parts of the String Theory Development Corporation, which aren’t really parts of anything but are also all the same thing: a set of corporations that are both component parts of each other and also separate from each other, that are a school but also not a school, acquiring, leasing, and using real estate with/to/from/for each other. And borrowing money from other people.

Of course, they’re not doing this for fun. The postmodern mereological wonderland of this arrangement has very a meaningful purpose: to maintain non-profit status and tax-exemption for everyone involved.

I’ll get to that in a moment. Before I end this section, I want to introduce the ensemble of minor characters in the String Theory Development Corporation drama.

Supporting characters

To get into this complex formation for the bond issuance, all the parties entered into something called an indenture, which is sort of like a guarantee for the bondholders. That indenture needs a Master Trustee, someone to oversee the whole affair. The U.S. Bank National Association, which is a subsidiary of US Bankcorp, is the Master Trustee.

Also on the bondholder side, Truist Securities, Inc. is the Underwriter, or the entity that purchases the bond. S&P Global Ratings assigned a rating of “BB+” to the Series 2020 Bonds, which is actually pretty high compared to the district itself, whose bonds get rated just above junk at BBB.

Don’t forget about the lawyers. Legal counsel is Ballard Spahr, a well-known corporate law firm in the region, and charter school finance experts Sand & Seidel are involved. Then there’s the PAID board:, Evelyn F. Smalls Chairperson. David L. Hyman, Esquire Vice Chairman, Thomas A. K. Queenan Treasurer.

Let’s look at the String Theory Governing Board. I’ve mentioned a couple of them but here’s the whole list and some of what they do. Here’s the composition:

Their bylaws are interesting. Each member serves a two-year terms (without limits, I think). They’re elected by a majority vote of the existing board, so it’s very insidery.

Plus, any potential Corporation Trustee must be chosen from the slate of nominations set forth by String Theory Schools. So not only must the existing board vote for you, but you can’t even be a candidate unless String Theory (which provides the business and academic services for the Corporation which is and is not the school) approves you.

Very democratic! Also, this board controls the school. Make no mistake about their power.

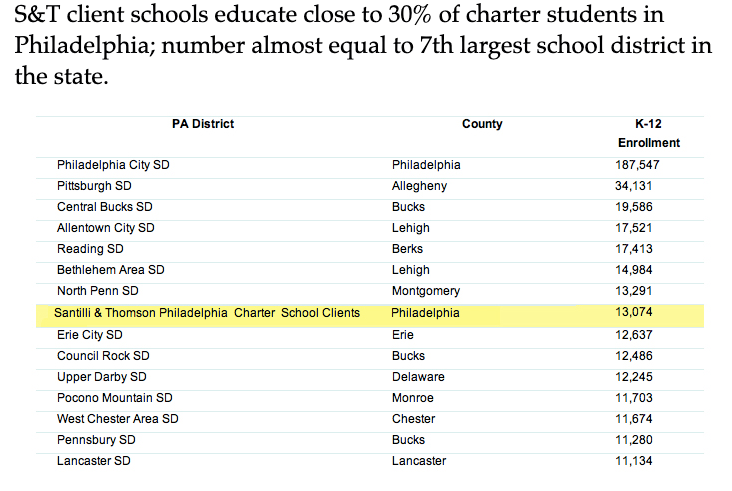

Finally, our friends Santilli & Thomson, LLC, serve as business manager, not just on this deal but to the School in general. Let’s spend a moment with them, since they’re super proud of the school district revenge fantasy they’re enacting in the city. Also, previous reporting said that it’s not clear what S&T does or how much it makes. The issuance tells us both.

First, it says that S&T is the Corporation’s (thing that is not a school but also a school) business manager. They provide the Corporation “with certain accounting, budget, financial reporting, cash management, payroll, and other financial services.” How much do they make on this arrangement?

S&T makes $191/student on basic and fiscal officer services. The issuance says that in 2020-1, the school had 2,641 students. That’s $504,431/year for those services. They also claim “certain additional charges,” so I’m thinking it’s a bit more as well.

All these characters make money on the cost of the bond issuance, which is almost $1.5 million. If you can believe it, all of this non-profit and tax exempt. I’ll go into that next time.